Tag: underlying

Knock-Out Option

What is a 'Knock-Out Option' A knock-out option is an option with a built-in mechanism to expire worthless if a specified price...

Yield-Based Option

What is 'Yield-Based Option' A type of debt-instrument-based option that derives its value from the difference between the exercise price and the...

Intrinsic Value

In the market of finance, the term intrinsic value can have two distinct meanings: Intrinsic value, is the difference between the strike price...

Naked Warrant

What is 'Naked Warrant' A warrant that is issued without a host bond. A naked warrant allows the holder to buy or...

Naked Put

How to Profit From Naked Puts and Call Options

A naked put is an option contract in which the writer of the option does not...

Backwardation

DefinitionNormal backwardation, also sometimes called backwardation, is the market condition wherein the price of a commodities' forward or futures contract is trading below the...

Binary Option

DefinitionA binary option is a financial option in which the payoff is either some fixed monetary amount or nothing at all. The two main...

Call Price

What is a 'Call Price' A call price is the price at which a bond or a preferred stock can be redeemed...

Call Date

DefinitionA callable bond is a type of bond that allows the issuer of the bond to retain the privilege of redeeming the bond at...

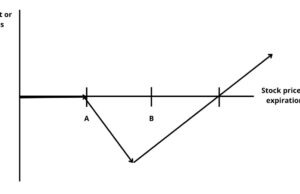

Backspread

A backspread is a type of options spread in which the trader holds more long positions than short positions. This strategy can be used...