A backspread is a type of options spread in which the trader holds more long positions than short positions. This strategy can be used to profit when the price of the underlying security moves in either direction. There are several different types of backspreads, each with its own set of benefits and risks. In this article, we will discuss how to set up and trade a backspread, as well as the risks associated with this strategy.

What is a backspread

A backspread is an options trading strategy that involves buying call options and selling put options at different strike prices, with the goal of making a profit if the underlying asset price moves higher. The backspread is generally used when the investor believes there will be a significant move in the asset price but is unsure of the direction. Because the backspread involves buying and selling options at different strike prices, it will typically result in a net debit to the trader’s account. However, if the move in the asset price is large enough, the backspread can generate a significant profit. While the backspread offers the potential for large profits, it also carries a large amount of risk and should only be undertaken by experienced traders.

Benefits of a backspread

Backspreads are often used in cases where the potential for loss is higher than the premium that can be charged for a traditional insurance policy. For example, a backspread might be used to insure against the possibility of a natural disaster. While the premium for such a policy would be high, the potential for loss is even greater. As a result, backspreads can help to protect against catastrophic losses that would otherwise be unmanageable. In addition, backspreads can also be used to insure against more specific risks, such as the failure of a key supplier. By hedging against these types of risks, businesses can reduce their exposure to potentially devastating losses.

Types of backspreads

There are three main types of backspreads: the bull call spread, the bear call spread, and the ratio call spread. The bull call spread is used when the trader believes that the underlying asset will increase in price. The bear call spread is used when the trader believes that the underlying asset will decrease in price. The ratio call spread is used when the trader believes that the underlying asset will stay relatively stable. Each type of backspread has its own risks and rewards, and traders must carefully consider which strategy is right for them before entering into a trade.

How to set up a backspread trade

To set up the trade, the first step is to choose the underlying asset and the strike prices of the options. The next step is to buy the lower strike price call option and sell the higher strike price call option. Be sure to take into account the bid-ask spread when placing your order. Finally, it’s important to monitor the trade and make adjustments as needed.

The key to a successful backspread trade is choosing the right underlying asset and strike prices. By doing so, you can position yourself for profits while limiting your downside risk.

Examples of how to trade a backspread

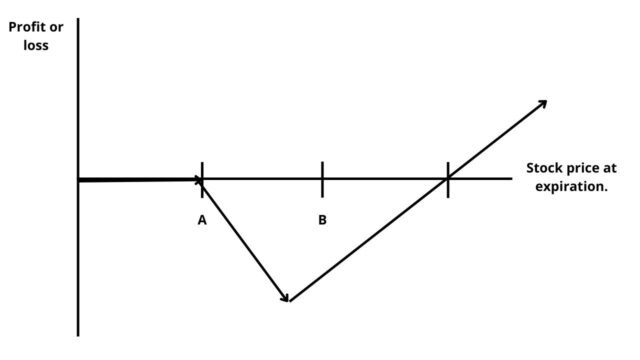

A backspread is an options trading strategy that is used when the trader believes that the underlying stock will make a big move, but is unsure of the direction. The backspread consists of buying a number of options at the money, and selling an equal number of options out of the money. For example, if a trader believed that ABC stock was going to make a big move, but was unsure if it would go up or down, they could buy 10 ABC $50 calls and sell 10 ABC $60 calls. If ABC stock went up to $55, the $50 calls would be worth $5, and the $60 calls would be worthless, for a total profit of $500. However, if ABC stock went down to $45, the $50 calls would be worthless, and the $60 calls would be worth $5, for a total loss of $500. While the backspread is a risky strategy, it can be profitable if used correctly.

Risks associated with trading a backspread

The first risk is that the strategy will only work if the underlying asset moves as expected. If the asset does not move as anticipated, the trade may result in a loss. Additionally, because the trade involves buying and selling options, there is also the risk of having to pay margin if the options move against the position. Finally, backspreads often require a large amount of capital in order to be successful, which can limit their appeal to some traders. Despite these risks, backspreads can be a valuable tool for those looking to take advantage of market moves in either direction.

Closing a position in a backspread

To close a backspread, the trader must first offset the short position. This can be done by buying an equal number of contracts as the original short position. Next, the trader must sell the remaining long position. This will result in a profit if the underlying asset has moved in the desired direction. However, if the asset has not moved or has moved in the opposite direction, the trader will incur a loss. As such, it is important to carefully consider both the potential upside and downside of a backspread before entering into the trade.