The blockchain finance landscape is changing fast and we need to keep up with both old and new laws. A big hurdle is, blockchain tech is innovative but the financial rules we have are old and were designed for traditional systems.

Lawmakers around the world are trying to create an environment that promotes the growth of blockchain, while also protecting investors and keeping the market and finances stable.

To manage within these unclear rules, businesses need a strong plan that considers risks, understands blockchain transactions, the people involved in them, and the potential problems.

As changes continue to happen, businesses need to be flexible and adapt their practices to keep within these new rules, and also use the opportunities that come with them.

Key Takeaways

- Blockchain finance involves navigating complex rules and overcoming both technical and governance challenges.

- Innovative business models, cost, and investment considerations are crucial elements in blockchain finance.

- Effective talent and skill development is key for the blockchain sector to progress.

- Trust-building and user-friendly interfaces are important for promoting blockchain adoption.

- An in-depth understanding of blockchain can help businesses fully tap into its potential in finance.

Addressing Technical Hurdles in Blockchain Finance

In addressing the technical hurdles in blockchain finance, one must both recognize and overcome the challenges related to scalability, interoperability, and integration with existing systems.

Scalability refers to the ability for a system to handle growing amounts of work. For blockchain, this translates to the capability of processing a large number of transactions in minimal time.

Interoperability, on the other hand, is the ability for different blockchain networks to interact and share information.

Lastly, integration with existing systems is crucial for seamless operation.

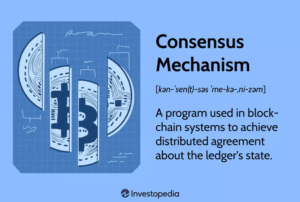

These challenges demand innovative solutions such as the development of more efficient consensus algorithms, creating standards for interoperability, and designing robust interfaces for integration of enterprise-grade blockchain.

Navigating these hurdles is key to unlocking the full potential of blockchain in finance.

Governance Issues in Blockchain Financial Systems

Handling governance, or the rules and processes, in blockchain financial systems is a challenging task. It involves setting up sturdy mechanisms for agreement or consensus and dealing with the issues of decentralized networks.

Good governance is necessary in these systems to keep things clear, accountable, and just. However, decentralized networks, which don’t have a central controlling authority, can lead to conflicts and disputes.

Even more issues come up when trying to establish consensus mechanisms. These are crucial to approve transactions and keep the blockchain working correctly. A good set of rules also needs to handle potential issues like people misusing their power and ensure everyone is treated fairly.

Sorting out these governance issues is a major task in blockchain finance, but it’s also a great opportunity to innovate.

Business Model Innovations in Blockchain Finance

New trends and improvements in blockchain technology are leading to big changes in how businesses in finance operate.

Features of blockchain like its decentralization, transparency, and security are changing old processes. This leads to creating new ways of providing value and earning money.

As an example, smart contracts help automate transactions, which can lower costs and increase productivity.

Another idea is about making assets into tokens. This allows people to have fractional ownership and brings liquidity to markets that were hard to access before.

Platforms that allow lending from peer to peer are changing finance by removing the need for traditional middlemen.

However, these ideas come with their own challenges, like meeting regulations and gaining public acceptance. So, businesses need to have a careful strategy to make the most out of what blockchain offers.

Talent and Skills Development for Blockchain Finance

As blockchain technology rapidly grows in the finance sector, there is a big need for people with the right skills who can handle this changing field.

Blockchain is changing traditional finance and it requires workers who understand not only the tech side of blockchain but also what it means for business, the rules around it, and the ethical issues.

Schools and companies need to put money into training programs to develop these skills. Working together with education providers, the industry, and rule-makers can help create a group of workers with the blockchain skills needed.

Also, encouraging a culture of always learning and coming up with new ideas is very important. This is because blockchain technology keeps changing, bringing new challenges and opportunities.

Cost and Investment Considerations in Blockchain Finance

Understanding the costs and investment needs for using blockchain in finance takes a lot of knowledge.

Setting up a blockchain system involves upfront costs. You need to pay for things like developing and setting up the software, setting up the infrastructure, and training employees. You also have to consider regular costs like maintaining the system, upgrading it, and staying within rules and regulations.

When deciding to invest in blockchain, businesses should not only think about the initial costs, but also the potential return on investment (ROI). They need to evaluate how much the technology can improve efficiency, create opportunities to earn more money, and give them an edge over their competitors.

However, it’s important to know that the return on investment from blockchain may not be immediate since the technology is still new.

Building Trust and Promoting Adoption in Blockchain Finance

While blockchain finance has a lot of potential, it’s very important to build trust and encourage people to use it to get the full benefits.

Some people might worry about safety and transparency because blockchain is decentralized. So, we need rules in place to protect the data and the interests of the users.

Teaching people about blockchain is also really important if we want people to start using it. Users need to understand the benefits, like how it’s fast, cost-effective, and easy to track. It’s also crucial to explain the technology simply to make it less intimidating.

Lastly, making this technology easy to use can help get past any resistance to this new technology.

Conclusion

Getting a handle on the rules around blockchain finance involves some challenges, but also some opportunities. It’s really important to overcome any technical or governance problems, come up with new ways of doing business, develop the right skills, and make smart investment decisions.

Building trust and getting people to use blockchain will also help to include it into financial tasks. Doing well depends on good planning and looking ahead. The key is to use blockchain’s potential for change but still stick to evolving rules.

Understanding this tricky field in detail will help companies to make the most out of what blockchain can do in finance.