Tag: bullish

Kicker Pattern

What is 'Kicker Pattern' A two-bar candlestick pattern that is used to predict a change in the direction of the trend for...

Head And Shoulders Pattern

What is a 'Head And Shoulders Pattern' In technical analysis, a head and shoulders pattern describes a specific chart formation that predicts...

Impulse Wave Pattern

What is 'Impulse Wave Pattern' A term used in the Elliott wave theory to describe the strong move in a stock's price...

Backspread

A backspread is a type of options spread in which the trader holds more long positions than short positions. This strategy can be used...

Cup and Handle

DefinitionIn the domain of technical analysis of market prices, a cup and handle or cup with handle formation is a chart pattern consisting of...

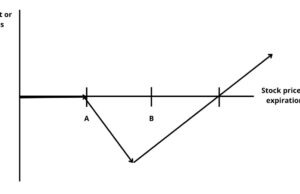

Call Ratio Backspread

What is 'Call Ratio Backspread' A very bullish investment strategy that combines options to create a spread with limited loss potential and...

Parabolic Indicator

What is the 'Parabolic Indicator' The parabolic indicator is a technical analysis strategy that uses a trailing stop and reverse method called...

Gamma Neutral

What is 'Gamma Neutral' A method of managing risk in options trading by establishing an asset portfolio whose delta rate of change...

Golden Cross

To understand the golden cross, we need to first get a sense of moving averages and, particularly, the short-term, and the longer-term moving averages....

Gartley Pattern

What is the Gartley Pattern

The Gartley Pattern is a Fibonacci-based price pattern discovered by H.M. Gartley in his 1935 book "Profits in the Stock...