Tag: spread

Yield Spread Premium

What is yield spread premium

Yield spread premium is the difference between the interest rate a borrower pays on a loan and the interest rate...

Implied Call

What is an implied call and how can you use it in your trading strategy

An implied call is a situation in which the underlying...

Nasdaq Intermarket

What is 'Nasdaq Intermarket' An electronic marketplace where National Association of Securities Dealer (NASD) members could execute trades, communicate, and receive quotations...

Narrow Basis

What is 'Narrow Basis' A condition found in futures markets in which the spot price of underlying commodities is close to the...

Oil Price to Natural Gas Ratio

What is 'Oil Price to Natural Gas Ratio' A mathematical ratio comparing the prices of crude oil and natural gas. In the...

Rate Anticipation Swap

What is 'Rate Anticipation Swap' A type of swap in which bonds are exchanged according to their current duration and predicted interest...

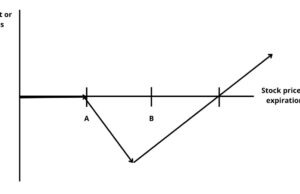

Backspread

A backspread is a type of options spread in which the trader holds more long positions than short positions. This strategy can be used...

Cambrist

What is 'Cambrist' An individual who is deemed to have above-average knowledge of the foreign exchange market. A cambrist can relate to...

Calendar Spread

DefinitionIn finance, a calendar spread is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the...

Callable Swap

What is 'Callable Swap' An exchange of cash flows in which one counterparty makes payments based on a fixed interest rate, the...