Tag: potential

The Shift Towards a Sustainable Wealth Creation in Governance (ESG) Factors

Increasingly, investors in real estate recognize the crucial role that Environmental, Social and Governance (ESG) factors play; this understanding is ushering a transformative shift....

Tips for Realizing Your Potential

What are your goals in life? Do you tend to focus on professional aspirations, raising a family, owning a home, or being physically healthy?...

6 Tips For Achieving Professional Growth In Your Career

Many people often neglect to work toward professional growth despite its benefits. It’s a frequent practice that once you find a good job, you...

Hedge Accounting

What is 'Hedge Accounting'

Hedge accounting is a method of accounting where entries for the ownership of a security and the opposing hedge are treated...

Yield To Worst (YTW)

What is the 'Yield To Worst - YTW' The yield to worst (YTW) is the lowest potential yield that can be received...

Rain Check

What is a rain check and how can it be used

A rain check is a document that allows the bearer to purchase an item...

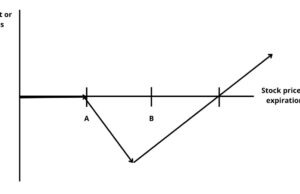

Backspread

A backspread is a type of options spread in which the trader holds more long positions than short positions. This strategy can be used...

Call Risk

What is 'Call Risk' The risk, faced by a holder of a callable bond, that a bond issuer will take advantage of...

Passive ETF

What is a Passive ETF and how does it work

A passive Exchange-Traded Fund (ETF) is a type of investment fund that aims to track...

Variable Universal Life Insurance (VUL)

What is 'Variable Universal Life Insurance - VUL' Variable universal life insurance (VUL) is a form of cash-value life insurance that offers...