The Importance of a Secure Banking Group

There are a lot of things to think about when it comes to your personal finances. But one of the most important things is security. That's why it's critical to have a secure banking group that you can trust. Here's a closer look at why a secure banking group is so important and how you can find one that...

Accidentally Paid Mortgage Twice? Here’s What to Do

It can be easy to accidentally pay your mortgage twice if you're not careful. Maybe you set up automatic payments and then make a manual payment on top of that. Or maybe you meant to pay half now and half later, but you wound up paying the full amount twice. Whatever the case may be, don't worry - this...

What Happens to Your Car When You Go to Jail?

One of the last things you're probably thinking about when you're headed to jail is what's going to happen to your car. But depending on the circumstances, your car could be just as much at risk as you are. Let's take a look at what happens to your car when you go to jail. If You're Arrested for a DUI If...

Here’s what you need to know about the Pediatrix Medical Group fake bill scam

If you've ever been on the receiving end of a medical bill, you know how confusing and daunting they can be. Even if you have insurance, it's not uncommon to receive a bill for services that weren't covered or that you thought were already paid for. So, imagine how confusing and frustrating it would be to receive a bill from...

Accidentally went over credit limit

It's easy to accidentally go over your credit limit. Whether you're making a large purchase or you've been using your card more frequently than usual, there are a number of ways that you can end up exceeding your credit limit. And while going over your credit limit may not seem like a big deal, it can actually have a...

CBG on Your Credit Report: What Does It Mean?

You may have seen the acronym CBG on your credit report and wondered what it stands for. CBG stands for credit bureau group. This is a collection of organizations that keep track of your credit history. The biggest credit bureaus in the United States are Equifax, Experian, and TransUnion. What Information Do These Groups Collect? These groups collect information about your...

Everything You Need to Know About Cash Deposit Night Drop Armored

Do you need to make a cash deposit but don’t have time during business hours? No problem! Many banks offer a cash deposit night drop armored service. Here’s everything you need to know about this convenient service. What is a Cash Deposit Night Drop Armored Service? A cash deposit night drop armored service is a safe and secure way to make...

The Consequences of Accidentally Claiming Exempt All Year

Every year, millions of Americans fill out their W-4 forms and send them off to their employers. For the most part, people don't give it a second thought. But what happens if you make a mistake on your W-4? What if you accidentally claim exempt all year? It's actually not as uncommon as you might think. According to the IRS,...

Checking Your Cox Business Credit Report

As a small business owner, you know that maintaining a good credit score is important to keeping your business running smoothly. You also know that checking your credit report regularly is a crucial part of maintaining a good credit score. But did you know that you can now get your business credit report from Cox? Getting Your Business Credit Report...

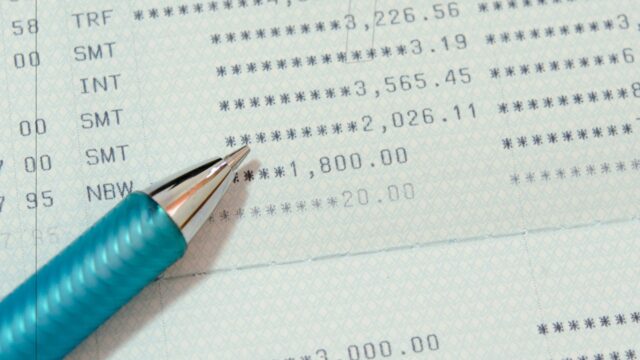

4 Reasons Why You May Have Received a Random ACH Deposit

If you've ever logged into your bank account only to see a mysterious deposit from an unknown source, you're not alone. Many people have received random ACH deposits at some point, and it can be confusing to try to figure out where the money came from. There are a few potential explanations for why you may have received a random...