For most people, Original Medicare Part A is free, yet having to pay the deductible, copay, and coinsurance can make things difficult for some financially. Medigap plans were devised to supplement the Medicare program. By design, they relieve the financial stress of out-of-pocket expenses.

With ten plans to choose from, it can challenging to sort out what each of them includes to decide which plan is the most appropriate. This guide to evaluating Medigap plans will help you understand the plans that are available to you and what they include.

Understanding the Basics of Medigap Plans

Medigap plans are offered by private insurance companies which means you can select any company you wish. The federal government requires the coverages under each of the ten Medigap plans to be the same regardless of which company you choose.

As you get quotes for Medigap, you will notice there is a difference in the range of premiums for the exact same coverage. This should be a factor in which company you choose to work with.

While there are ten Medigap plans in total, you may not be able to choose some of them. The choices that are available to you depend on when you first enrolled in Medicare. Boomer Benefits explains Medigap plans in several ways on their website.

Eligible Medigap Plans for Consumers Who Enrolled Before January 2020

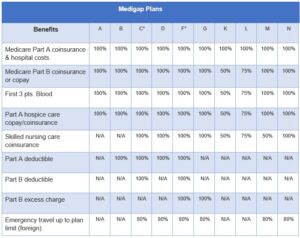

Consumers who enrolled in Original Medicare before January 2020 can choose any of the ten plans they wish. The plans are named alphabetically A, B, C, D, F, G, K, L, M, and N.

The most popular plan for those who enrolled in Medicare before January 2020 is Plan F. Plan F offers more coverage for out-of-pocket expenses such as deductibles, copays, and coinsurance than any other plan. Plan C runs a close second to Plan F as far as being popular with consumers as it also has comprehensive coverage.

The following chart explains what each plan covers:

*Plans C and F are not available for consumers who enrolled after January 2020.

Other Things to Note about Medigap Plans

- Plan F covers the 15% in excess charges that doctors who don’t participate in Medicare can charge.

- The closest plan to Plan F for consumers who enrolled in Medicare after January 2020 is Plan G. The main difference is Plan G doesn’t cover the Part B deducible or excess charges.

- Plan D is the closest to Plan C. The main difference is it doesn’t cover the Part B deductible or excess charges.

- Depending on your circumstances, Medigap plans may not cover pre-existing conditions or may have a waiting period before they’re covered.

- Insurance companies have different ways to rate your premiums which can make a significant difference in how much you pay for coverage.

The Impact of How Insurance Companies Rate Premiums

The federal government does not control the premiums for Medigap plans, and it doesn’t require insurance companies to rate their premiums according to certain rules.

Insurance companies generally use one of the following three pricing models when establishing premiums for Medigap plans:

- Attained age – Insurers base premiums on the age you attained at the time of the enrollment.

- Community rated – Everyone pays the same premium for the same plan in a certain area, no matter how old they are.

- Issue age – Insurers base the premium on the enrollee’s age at the time the policy was issued. Younger individuals pay less. Any premium increases in the future will not be based on your age.

As you can see, the basis for how an insurance company rates premiums may make a significant impact on the pricing. It’s prudent to ask the insurance company which pricing model they use so you will know if the price will rise as you get older.

Final Thoughts

It’s best to purchase your Medigap coverage during the regular open Medigap enrollment period which is based on your Part B effective date. It may cost more if you purchase it outside the enrollment period, and insurers could decline coverage altogether.