In the evolving landscape of the post-pandemic world, the gig economy has witnessed a significant surge. Businesses are increasingly turning to independent contractors or freelancers to streamline work processes and save time. While this approach offers flexibility and efficiency, it comes with the responsibility of tax reporting.

For businesses engaging with independent contractors, Form 1099-NEC is a crucial aspect of tax compliance. In this blog, we’ll dive into the intricacies of Form 1099-NEC, helping you understand its purpose and how to navigate it for the upcoming tax season.

What is Form 1099-NEC?

Form 1099 NEC is an IRS tax form specifically designed to report payments of $600 or more made to non-employees for services rendered during the year. Non-employees encompass individuals who are not regular employees, including independent contractors, sole proprietors, and other service providers.

The introduction of Form 1099-NEC in 2020 marked a shift from reporting such payments on Box 7 of Form 1099-MISC in previous years. It’s important to note that Form 1099-MISC is still in use for reporting other types of payments, such as rent, royalties, fishing boat proceeds, and legal services.

Who Needs to File Form 1099-NEC?

Your business is required to file a Form 1099-NEC for each independent contractor if the following conditions are met:

- The payment was made to someone who is not your employee.

- The payment was made for services in the course of your trade or business.

- You paid an individual, single-member LLC, partnership, or LLC taxed as a partnership.

- The payments totaled $600 or more during the tax year.

Additionally, if you withheld any federal income tax from nonemployee compensation payments under the backup withholding rules, Form 1099-NEC must be filed, regardless of the amount.

Key Considerations and Exceptions

It’s important to note that Form 1099-NEC is not required for payments to corporations or LLCs taxed as corporations, with a few exceptions outlined in the IRS Instructions for Form 1099-MISC and 1099-NEC.

Furthermore, payments made by credit card, debit card, or through third-party payment processors like PayPal or Stripe do not require a 1099-NEC. Such payments are included in a 1099-K issued by the financial institution or payment processor.

Deadline and Penalties for Form 1099-NEC Filing

Deadline for Filing:

Both the federal and recipient copies of Form 1099-NEC must be submitted on or before January 31, regardless of the filing method. If the deadline falls on a weekend or federal holiday, the deadline automatically extends to the next business day. Failure to file before the deadline can result in penalties.

Penalties for Late Filing:

The penalties for late filing of Form 1099-NEC vary based on the duration of the delay. Here is a breakdown:

– $60: Up to 30 days late

– $120: More than 30 days late but before August 1st, 2024

– $310: Filing on or after August 1st, 2024

– $630: Intentionally neglecting to file

Businesses must adhere to the filing deadline to avoid these penalties, which can range from $60 to $310 per missed 1099 tax form.

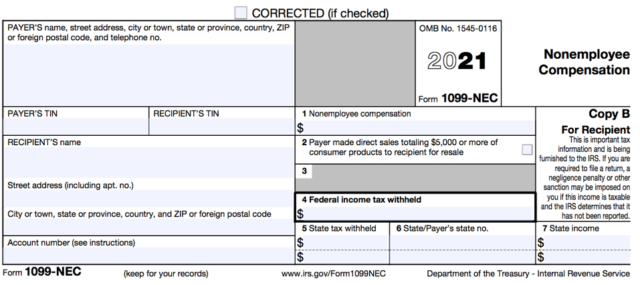

How to Fill Out and Read Form 1099-NEC: A Step-by-Step Guide

- Payer’s Information:

Enter the payer’s name, address, and taxpayer identification number (TIN).

- Recipient’s Information:

Include the recipient’s name, address, and TIN.

- Non-Employee Compensation Amount (Box 1):

Report the total amount of non-employee compensation paid during the year in Box 1.

- Box 2:

Check this box if $5,000 or more was sold for resale or other purposes. Note that the total amount is not reported on Form 1099-NEC but is included in the small business tax return, typically on Schedule C.

- Federal Income Tax Withheld (Box 4):

Report any federal income tax withheld from a backup withholding notice in Box 4.

- State Information:

Boxes 5, 6, and 7 contain state-specific information. Box 5 displays any state tax withheld, Box 6 is a specific identification number for each state, and Box 7 shows the total state income for the non-employee for the year.

Why Would I Receive a 1099-NEC?

If you work as an independent contractor, freelancer, or self-employed individual, you should receive a Form 1099-NEC from any business that paid you at least $600 during the tax year. However, if you were paid by credit or debit card or through a third-party payment processor like PayPal, you won’t receive a 1099-NEC for those payments.

Businesses are required to send you a copy of your 1099 form by January 31 of the following tax year. This copy is also sent to the Internal Revenue Service (IRS). Therefore, it is essential to ensure that the compensation reported on your 1099-NEC aligns with the income you report on your tax return, whether through Schedule C attached to Form 1040 or a separate business tax return. Understanding these filing and reporting requirements is crucial for both businesses and independent contractors to navigate the tax season successfully.

Bottom line

In conclusion, understanding Form 1099-NEC is essential for businesses gearing up for the upcoming tax season. This form, introduced to separate nonemployee compensation from other types of payments, demands careful attention and compliance to ensure a smooth and error-free filing process. If you have specific questions about filing tax forms for independent contractors it is always helpful to reach out to a CPA or tax preparer.

By understanding the nuances of this form, businesses can avoid penalties, streamline their reporting procedures, and foster a transparent relationship with contractors and freelancers.

As we approach the tax season, businesses must stay informed about any updates or changes in tax regulations.