Private debt has solidified itself as one of the steadier segments in capital markets, drawing consistent institutional investment while traditional bank lending continues to retrench. Amid global uncertainty and tight credit conditions, private lenders are stepping in to meet demand, offering capital to businesses that may not meet the criteria of conventional financing.

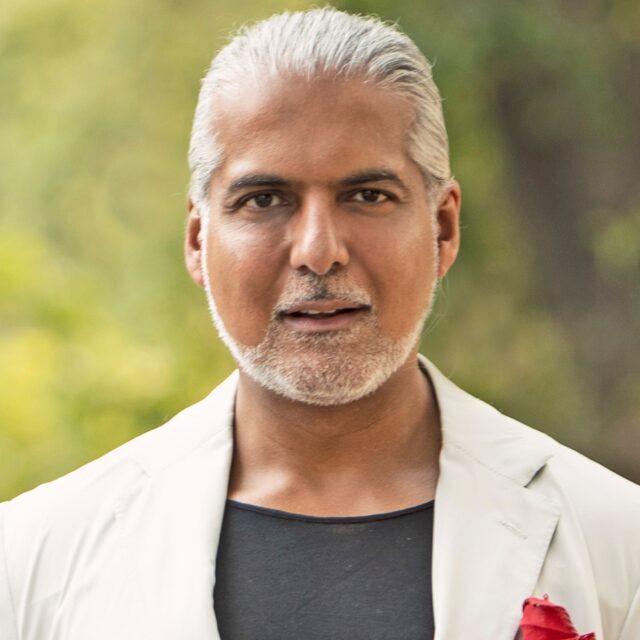

One of those lenders is Arif Bhalwani, CEO of Third Eye Capital, a Toronto-based firm that has been active in private credit since 2005. With over $5 billion deployed, Third Eye Capital has focused on providing credit to companies navigating financial or operational complexities.

“In situations where conventional lenders step away, we evaluate a company’s actual value,” says Bhalwani. “We look at a company’s potential to generate value, the strength of its operations, and its ability to recover or grow. A company’s true net worth is often misjudged when the analysis is limited to past financial performance.”

In 2024, private debt maintained its status as a reliable asset class, even as global fundraising declined across most private market strategies. Capital deployment increased across private markets, and direct lending activity picked up in both North America and Europe. Even as banks regained some market share, investor demand for private credit remained strong.

Pension funds, insurers, and family offices are increasingly allocating capital to private credit. Consultants at Mercer reported that half of large asset owners expect to increase their exposure to private credit this year.

Direct lending, focused on senior-secured loans to mid-market borrowers, led much of the activity. While institutional giants dominate headlines, lenders like Third Eye Capital have built reputations for stepping into difficult deals that require custom structuring and faster execution timelines.

Third Eye Capital has built its lending approach around supporting companies in transition, those with volatile earnings, or firms operating in industries undergoing structural change. Rather than relying on credit scores or typical financial ratios, the firm considers collateral, business models, and management adaptability.

“Our view is that complexity creates opportunity,” Bhalwani explains. “We work closely with borrowers to understand what’s really driving performance and where capital can have the greatest impact on preserving or rebuilding net worth.”

This approach is picking up momentum as refinancing needs grow across the economy. With over $600 billion in high-yield bonds and leveraged loans maturing in the next two years, demand for flexible credit solutions is almost certainly going to rise. Those companies will be seeking lenders who can assess their needs beyond conventional thresholds.

Private credit’s stability has made it attractive during periods of volatility, but disciplined underwriting remains the key ingredient. As competition increases, firms are under pressure to maintain returns without loosening their standards.

Bhalwani emphasizes that net worth, in the lending context, goes beyond a simple tally of assets and liabilites assets and liabilities. “Net worth is also about decision-making, market positioning, and resilience,” he explains. “We focus on whether a business can absorb shocks and respond strategically. That’s what truly drives long-term value.”

In summary, private debt itself is showing the kind of resilience that Bhalwani seeks in partner companies, which attracts both investor capital and borrower interest in a rapidly shifting economic landscape. As global financing needs shift by the week, lenders like Third Eye Capital are playing an increasingly pivotal role, offering capital where it’s most needed and applying frameworks built on analysis rather than convention.

For Bhalwani, staying grounded in fundamentals is key. “We focus on the strength of management and the core attributes that define a great business,” he says. “That’s where real net worth is built, and where lasting resilience takes root.”