Tag: reverse

Knock-Out Option

What is a 'Knock-Out Option' A knock-out option is an option with a built-in mechanism to expire worthless if a specified price...

Reverse Mortgage

DefinitionA reverse mortgage is a type of home loan for older homeowners that requires no monthly mortgage payments. Borrowers are still responsible for property...

Sale and Repurchase Agreement (SRA)

What is 'Sale and Repurchase Agreement - SRA' An open market operation, implemented by the central Bank of Canada, that is designed...

Backflip Takeover

What is 'Backflip Takeover' An uncommon type of takeover in which the acquirer becomes a subsidiary of the acquired or targeted company,...

Back Door Listings

When a company fails to meet the listing requirements of a stock exchange, it may turn to a back door listing as a way...

Backspread

A backspread is a type of options spread in which the trader holds more long positions than short positions. This strategy can be used...

Canceled Order

What is 'Canceled Order' 1. A previously submitted order to purchase or sell a security that is canceled before it has been...

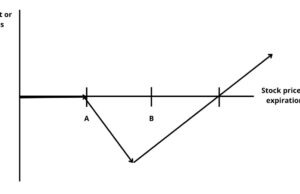

Call Ratio Backspread

What is 'Call Ratio Backspread' A very bullish investment strategy that combines options to create a spread with limited loss potential and...

Parabolic Indicator

What is the 'Parabolic Indicator' The parabolic indicator is a technical analysis strategy that uses a trailing stop and reverse method called...

Targeted Accrual Redemption Note (TARN)

What is a ‘Targeted Accrual Redemption Note – TARN'

A targeted accrual redemption note (TARN) is an investment vehicle, calculated based on a variation of...